From being the world’s biggest manufacturer, often referred to as the ‘factory of the world’, to soon become the third biggest consumer market after the US and Japan by 2015, according to a study by McKinsey, the retail sector of China is flourishing and attracting global retailers to bank on the opportunity each passing season. Be it the e-market that is pumping in sales for foreign brands which still don’t have their physical stores setup within the country, to the growing luxury market and also the progressive tastes of the Chinese customers, every aspect of China’s growing consumerism is making it the next big destination for shopping and sales…

From being the world’s biggest manufacturer, often referred to as the ‘factory of the world’, to soon become the third biggest consumer market after the US and Japan by 2015, according to a study by McKinsey, the retail sector of China is flourishing and attracting global retailers to bank on the opportunity each passing season. Be it the e-market that is pumping in sales for foreign brands which still don’t have their physical stores setup within the country, to the growing luxury market and also the progressive tastes of the Chinese customers, every aspect of China’s growing consumerism is making it the next big destination for shopping and sales…

mong the fastest growing economies of today, China’s Gross National Income (GNI) per capita has expanded 13 times over the past two decades, and the total urban consumption by 2015 is likely to exceed 13.3 trillion renminbi (US $ 1.96 trillion), with the average income of the Chinese consumers growing and so has the capacity to spend.

Within the current structure of the Chinese clothing market, domestic brands play a critical role in the mass segment, such as men’s shirts, knitted underwear, down coats, jackets, pants and sweaters. After all this segment has always been China’s core strength in manufacturing even in the international marketplace. In fact, the middle and low end of the market has a product mix of foreign and domestic brands, with most of the goods being manufactured in China. This is a market which is not easy to penetrate for those looking at entering the Chinese market.

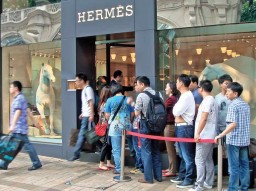

However, the high-end market is dominated to a large extent by overseas brands, which are expected to accelerate their expansions into China. The market is diverse with the high-end domestic clothing market in China being dominated by brands of European origin and other imported products, such as Giorgio Armani, Cerruti 1881, Hugo Boss, Dunhill, Chanel, Dior, Ermenegildo Zegna and Salvatore Ferragamo. Set to account for more than 20 per cent of the world’s luxury market by 2015, according to market reports, luxury consumption in the country is predicted to grow 18 per cent annually from 2010 to 2015, and reach US $ 27 billion by 2015. In 2006, Gucci had six stores in China but it now has 39, while Hermes quadrupled its stores from five in 2005 to 20 today.

Flourishing not only as a market, but moving up the value chain, the country is also bringing production to its doors, becoming a manufacturer of luxury goods, as the clothing industry still possesses great competitive advantage in terms of labour cost, lead time, vertical integration of the industry, the variety of products, and political stability from a Chinese perspective. While 20 per cent of Prada’s luxury collection is now made in China, French luxury group LVMH’s Moet is also planning to start production of its sparkling wines in the remote Ningxia Hui region.

Although the luxury market is the fastest growing, the country still has a great market capacity for mass fashion. The rapid growth rate of mass fashion provides a larger market space to affordable fast fashion brands such as Zara, H&M, C&A, Next and UR. In the market segment of men’s shirts, domestic brands enjoy the lion’s share. Most men’s shirts all over the world are made in China. Youngor, Firs, Conch and Rouse are the top four brands in the domestic market.

With a rising number of working women, the demand for women’s clothing, both business and casual, is expected to experience a great increase. It can be estimated that the women’s office wear and business casual wear markets will be the fastest growing segments. Because of the promising future market in children’s wear, a number of domestic brands which previously focused on adult clothing are attempting to enter this market by expanding their product lines. The prominent kids’ brands include Yaduo, Shuihaier, M-linge and Yeeshow. Most of them are usually much cheaper than the foreign brands and are distributed via different channels.

Since the 2008 Beijing Olympic Games, sport has become a part of lifestyle and fashion attitudes in China, which is making a booming market for sportswear as well as clothing and footwear for outdoor activities. Domestic brands such as Li-Ning, Peak, 361 and Anta are gaining a larger share of the domestic market compared with previous years.

Chinese tourists, a growing market…

While new players are entering the country, and already existing ones continue to reap the profits of this growing economy, brands are also eyeing the Chinese travellers who are growing in number each passing year, as the country is today the world’s fastest growing travel market. With 65 million outbound departures expected this year, the UN World Travel Organization estimates that there will be 100 million Chinese outbound trips by 2020, and travel will become a top priority for the newly wealthy in a country, these travellers are spending on international brands extravagantly. Last year Chinese tourists accounted for a fifth of all tax free sales across the UK, increasing by 31% Y-O-Y, Luxury brands are set to benefit the most from this uplift, with high-net-worth Chinese spending on average £712 per tax free transaction favouring handbags, jewellery and watches.

One of the biggest impacts of Chinese booming tourism is seen in the preparations made for the Chinese New Year, turning the predominantly local event into a global celebration for apparel and luxury brands around the world, especially in Europe and the United States. In 2012’s Year of the Dragon, brands seizing the opportunity developed specific products for the Chinese market, drawing heavily on local mythology and design clues. Even more brands have joined the fray in 2013, looking to capitalize on the snake’s symbolism of good fortune, as an ancient symbol of power and temptation. Be it Alfred Dunhill, Bulgari, Davidoff, Gucci, Louis Vuitton, or Harrods, everyone had something unique to offer to the clients.

“Chinese shoppers represent the most significant, and rapidly growing, proportion of our international customer base. We attribute this performance to our continued drive to provide these visitors with a tailored shopping experience unrivalled by any other store. Chinese New Year affords us an exciting opportunity to give something back to these customers by paying tribute to their country’s rich tradition,” said a spokesperson from Harrods.