Senior figures from Bangladesh’s business community have urged the government to ease what they describe as an excessive tax burden, even as the Bangladesh Bank governor pushed back against suggestions that international lenders dictate the country’s economic policy.

At a recent industry event, Apex Footwear Managing Director Syed Nasim Manzur said businesses were seeking urgent relief from the pressures of Advance Income Tax (AIT) and Tax Deducted at Source (TDS), which he characterised as a form of ‘tax terrorism’. He acknowledged improvements made by the National Board of Revenue — including progress in bond automation and the removal of irregularities relating to HS codes — but stressed that companies remained strained by the current tax structure. He also urged Bangladesh Bank to revisit prevailing lending rates.

Manzur criticised the government for adhering too rigidly to recommendations from institutions such as the World Bank and the International Monetary Fund (IMF), arguing that this had contributed to an economic environment that was increasingly difficult for businesses to navigate.

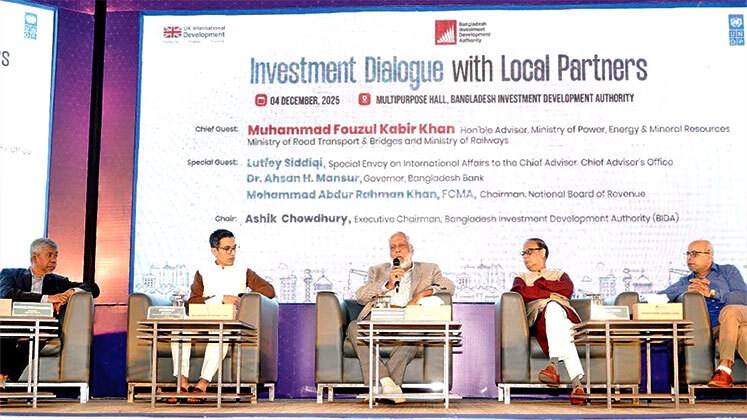

Responding to such concerns, Bangladesh Bank Governor Dr Ahsan H Mansur dismissed the notion that the country’s economic policies were being shaped by external agencies. He forecast that inflation would fall to 5% by the end of the 2025–26 fiscal year, enabling lending rates to stabilise at between 10% and 11%, with the policy rate settling between 8% and 9%. However, he cautioned against reducing borrowing costs prematurely, warning that doing so before inflation stabilises could destabilise both the money market and the exchange rate.

Dr Mansur contrasted Bangladesh’s economic conditions with those of China and India, noting that their comparatively low interest rates — 3% and close to 0% respectively — reflect very different macroeconomic realities. He added that the domestic financial sector had recovered from earlier data distortions that had posed significant risks.

On concerns regarding the recovery of overdue loans through the sale of industrial assets, he argued that industries should not be penalised for mismanagement by individual owners.

Energy Adviser Muhammad Fouzul Kabir Khan took a sharper tone, noting that many of Bangladesh’s wealthiest individuals were those who had secured bank loans but failed to repay them. He said the private sector had benefited from ‘crony capitalism’, in which business success was tied to political connections rather than innovation. However, he added that the systemic issues at play were longstanding and not solely the fault of private enterprises, stressing that the government’s ongoing reforms aimed to create new opportunities anchored in production and innovation.

The event was presided over by Ashik Chowdhury, Executive Chairman of the Bangladesh Economic Zones Authority (BEZA) and the Bangladesh Investment Development Authority (BIDA).